Crypto in the Trump Era: Four Years of Deregulation, Fraud, Chaos—but Also Opportunities

The Wild West of Crypto: A Decade of My Observations on Evolution, Fraud, and Scams

By Jenny Q. Ta

Listen to the audio version here:

For nearly a decade, I’ve been outspoken about the transformative power of crypto. My Substack has long served as a repository for these observations, tracking the evolution of blockchain, Bitcoin, and decentralized finance. Since late 2015, I’ve described the crypto space as a modern-day Wild West—volatile, chaotic, BUT BURSTING WITH OPPORTUNITIES. Today, that analogy holds true more than ever as we enter another era of political and technological convergence with crypto at its center.

Since election night, when Trump secured his victory, we’ve witnessed a surge in blue-chip cryptocurrencies like Bitcoin, Ethereum, Solana, Dogecoin, and XRP. Bitcoin, now on the verge of its 16th birthday next month, continues to cement its position as the benchmark for digital assets. Solana and Ethereum are pushing the boundaries of blockchain scalability and functionality, while Elon Musk’s Dogecoin retains its cultural and speculative appeal. Yet, alongside these triumphs lies the darker side of the industry—the proliferation of fraudulent tokens and memecoins that highlight the risks and volatility still inherent in the crypto space.

Now that Trump has flipped to being pro-crypto with the launch of his own coin, and with Elon Musk consistently supporting Dogecoin, Tesla owning Bitcoin, and Musk’s platform X (formerly Twitter) reportedly working on a crypto payment system speculated to involve XRP, Dogecoin, or some hybrid, it’s clear the convergence of political and tech leaders is reshaping the crypto landscape. This powerful alignment is accelerating mainstream adoption while simultaneously introducing new layers of complexity and challenges to an already volatile industry.

Take $HAWK, for example. Created around the brand of influencer Hailey Welch, also known as the Hawk Tuah Girl, this memecoin launched on Solana with great anticipation. Welch was reportedly paid $125,000 upfront to market the token and promised 50% of the net proceeds following its launch. “The token initially skyrocketed to a $490 million market cap immediately after its release—an incredible result for a memecoin.”

However, within just two minutes, the insiders, including Welch and her team, sold off their entire supply, causing $HAWK’s market cap to plummet to $25 million.

This devastating crash wiped out up to 95% of buyers' investments, leaving many holding onto the tokens in their wallets, clinging to the hope of a miracle recovery. The shocking collapse sparked widespread allegations of insider trading, “rug pull” schemes, and pump-and-dump tactics.

YouTuber Coffeezilla breaks it down here: “exposing the hawk tuah scam”

The SEC complaints against $HAWK reveal the inherent risks of speculative tokens, where such fraudulent practices remain alarmingly common. Despite crypto’s undeniable progress, incidents like this tarnish the industry’s reputation and underscore the urgent need for discernment and regulation.

A Pro-Crypto Stance Isn’t a Political Endorsement

As crypto rises again, I’ve faced misplaced assumptions from a few friends who support Kamala, as I do, for being pro-crypto. Some have conflated my stance with being pro-Trump simply because Trump has recently embraced crypto—a laughable oversimplification that disregards my longstanding support for the technology.

I’ve been pro-crypto since 2015, and I’ve documented this extensively on my Substack, long before Trump entered the political arena. During his first term, Trump was anti-crypto, dismissing Bitcoin and blockchain outright. My support for crypto persisted through Obama’s administration, Trump’s first term, and Biden’s presidency. It remains unchanged today as Trump shifts to a pro-crypto stance, likely influenced by his new ventures like World Liberty Financial (WLFI).

WLFI uses an ERC-20 governance token built on the Ethereum blockchain, which could drive significant activity and potentially pump Ethereum, while his administration and allies are reportedly major investors in Solana ($SOL). Trump has further signaled his commitment to the space by appointing former PayPal executive David Sacks as the AI and crypto czar in his administration. Sacks, a prominent investor in Solana, underscores the administration’s focus on pushing blockchain innovation and fostering growth in ecosystems like Ethereum and Solana, which could significantly reshape the competitive landscape.

Elon Musk’s actions further illustrate the growing synergy between tech giants and digital currencies. From Tesla’s Bitcoin holdings to his unwavering support for Dogecoin, Musk has been a pivotal figure in driving crypto’s visibility. Speculation about X (formerly Twitter) developing a crypto payment system—possibly involving XRP, Dogecoin, or a hybrid solution—underscores how deeply embedded crypto is becoming in the broader tech ecosystem. Being pro-crypto, however, is not about political allegiance; it’s about recognizing the transformative potential of blockchain in the digital economy.

The Bigger Picture: Pro-Crypto, Against Bad Actors

As Bitcoin approaches its 16th anniversary, its journey highlights both the immense promise and the persistent flaws of the crypto space.

I do strongly believe that blockchain, Bitcoin, and CRYPTO NAYSAYERS WILL BECOME IRRELEVANT OVER THE NEXT FOUR YEARS—resisting this movement is like rowing upstream against a current that’s only growing stronger. The world is moving toward blockchain and digital innovation, and those who don’t adapt will simply be left behind.

However, being pro-crypto doesn’t mean turning a blind eye to its flaws. I’ve shared my strong sentiments about Coinbase, which continues to manipulate the crypto space by freezing accounts and blocking withdrawals—a pattern that countless users have complained about. What Coinbase does is, in my view, outright criminal. Founder and CEO Brian Armstrong’s Coinbase may not have directly donated to groups spending on the presidential race, but it has funneled tens of millions of dollars into the pro-crypto Super PAC Fairshake and associated organizations. These groups have actively targeted congressional races, aiming to defeat Democrats who have tried to rein in crypto markets. It’s safe to say that Coinbase will continue its practices, regardless of complaints, as it prioritizes protecting its own interests—not that of its users. Its bottom-line focus lies in driving up stock prices, allowing Coinbase executives to cash out their wealth, all while touting narratives about being "debanked" and claiming that decentralization is the way forward, even as they operate as a centralized entity.

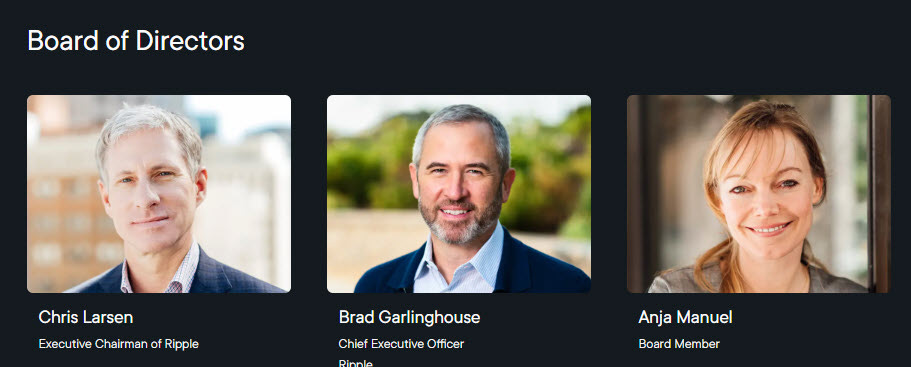

Before giving Brian Armstrong too much credit, it's essential to acknowledge the broader influence of Fairshake. Ripple CEO Brad Garlinghouse has stated that the SEC’s adversarial stance toward crypto was the primary reason his company and two others created Fairshake, now the largest industry Super-PAC in the space. This highlights the lengths to which the crypto sector has gone to counteract regulatory hostility. Rarely in American politics has a new industry spent so much money with such apparent impact as the cryptocurrency sector did in the last election.

Notably, Chris Larsen, co-founder and chairman of Ripple, emerged as one of the crypto industry’s largest individual donors this cycle, contributing $1 million worth of XRP tokens to Fairshake in August and bringing his total donations to over $11.8 million to PACs backing Vice President Kamala Harris’ campaign.

I find it quite interesting that both Garlinghouse and Larsen, two of Ripple’s top executives, appeared to be betting on different teams—a common hedge political strategy in American politics. While Larsen aligned with PACs supporting Harris and Democratic campaigns, Fairshake’s broader influence targeted bipartisan efforts, demonstrating how key players in the crypto industry strategically navigate political landscapes to protect their interests and ensure regulatory outcomes that benefit them.

Fairshake, one of the top-spending PACs this year, has played a pivotal role in shaping the political landscape for crypto. In September alone, the committee distributed nearly $29 million. Of that amount, $15 million went to the Defend American Jobs PAC, which focuses on cryptocurrency and blockchain policies that favor Republicans, while $5 million went to Protect Progress, a PAC exclusively supporting Democrats. The remaining $8.8 million was funneled into key House races in New York, Nevada, and California, according to FEC data compiled by the Breadcrumbs crypto market and blockchain analyst Delmore and verified by CNBC.

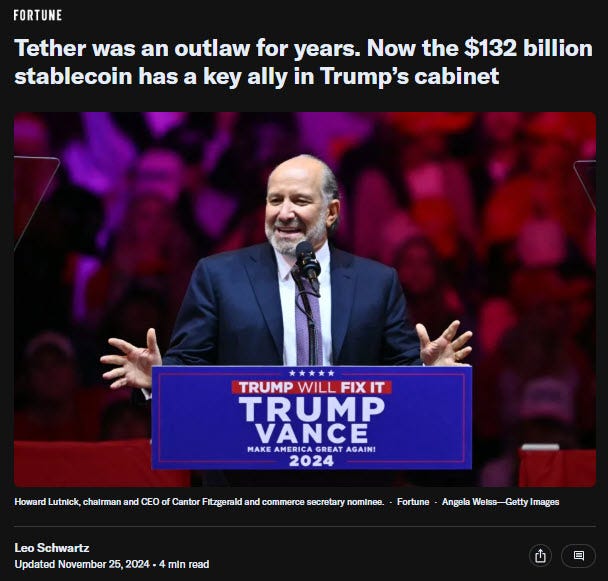

Similarly, Tether, while central to Bitcoin’s liquidity, continues to print tokens out of thin air to inflate the market, blending artificial pumps with legitimate liquidity from traditional finance. Tether was considered an outlaw for years, but now the $138 billion stablecoin has found a powerful ally in Howard Lutnick, CEO of U.S. financial services firm Cantor Fitzgerald and President-elect Donald Trump’s pick for commerce secretary. Cantor Fitzgerald serves as the main custodian for Tether’s U.S. Treasury bills, the primary asset backing the stablecoin. Lutnick, known for rebuilding Cantor Fitzgerald after the tragic loss of 658 employees on 9/11, has been openly touting Tether in recent TV appearances. According to a report in The Wall Street Journal, Lutnick has even acquired a 5% ownership stake in the crypto firm.

So, if we haven’t seen an audit from Tether in the 5-6 years since they first claimed they would provide one, it’s unlikely we’ll get one within the next four years. Why bother with an audit to prove legitimacy and authenticity when you already have cozy connections pulling the strings for you?

Despite these persistent flaws—issues that, in my opinion, are unlikely to be resolved anytime soon, especially during four years of Trump’s deregulations and extreme pro-digital asset policies—I have always been pro-crypto, not just since the election but long before it. As a VC running a fund, I’ve backed numerous crypto projects. I’ve lost a lot of money, made a lot of money, and through it all, I’ve remained steadfast in my belief that crypto and blockchain are here to stay. They are still in their early stages, but they represent a legitimate asset class with immense potential.

While this is NOT investment advice, we all know cryptocurrencies are highly volatile, carry significant risks, and can result in total loss in the blink of an eye.

But let’s not forget that the same can be said of penny stocks and the traditional financial system, which is no stranger to toxic assets. Despite the risks, Bitcoin could easily double or triple over the next four years, particularly under a deregulated Trump administration. Trump’s own ventures, including his token and other crypto initiatives, will likely ride this momentum.

Additionally, Trump’s administration is heavily tied to Solana ($SOL), with figures like David Sacks reportedly being major investors in the blockchain. If Solana continues on its trajectory, it could reach unprecedented highs, potentially hitting $1,000 per $SOL. At that valuation, Solana’s market cap would soar to approximately $589.55 billion, surpassing Ethereum’s current market cap of $485.37 billion. This would position Solana as a dominant force in the crypto space, propelled by its efficiency, scalability, and institutional backing.

Trump’s deregulatory policies and the administration’s vested interest in Solana could make it one of the most explosive assets of the next four years, reshaping the dynamics of the crypto ecosystem and challenging Ethereum’s long-held dominance in the blockchain arena.

Embracing Progress in a Digital World

We live in a world dominated by AI and the digital age, and those who fail to embrace these advancements will inevitably be left behind.

Frankly, no one will care—because the pace of innovation moves forward regardless of who keeps up. Society rewards those who adapt and contribute to progress, while those who resist or fail to understand these shifts fade into irrelevance. In a rapidly evolving digital economy, the world has little patience for outdated mindsets or those who ignore technological advancements. Simply put, progress doesn’t wait for anyone.

Case in point: Nancy Pelosi now boasts a net worth of nearly $300 million.

How could anyone forget that she’s one of the highest-ranking Democrats? It’s almost as if she’s been a crypto trader, hitting every token that ever launched. Whether through traditional investments or modern financial tools like blockchain, those who understand how to leverage innovation continue to succeed, while others watch from the sidelines.

The point is, politics has always been dirty laundry. We win some, we lose some. What matters is staying relevant, championing innovations like blockchain and crypto, and staying righteous in a space where the stakes—and the opportunities—have never been higher.

The Pitfalls of Celebrity-Endorsed Memecoins: The $HAWK Debacle

Celebrity-endorsed memecoins have a notorious track record of leaving investors devastated, and $HAWK is no exception. Promoted by Hailey Welch, known as the "Hawk Tuah Girl," $HAWK initially soared to a staggering $490 million market cap upon its Solana launch. However, within just two minutes, insiders—including Welch's team—dumped their holdings, causing the token's value to plummet to $25 million. Investors lost up to 95% of their funds, with many still clinging to worthless tokens in hopes of a miracle recovery. This dramatic rise and fall echoes previous celebrity-backed failures, including 50 Cent’s token, which lost 99.9% of its value, Andrew Tate’s, which plunged by 73.2%, and Amber Rose’s, which dropped by 97.6%.

Adding to the controversy is Alexander Larson Shultz, aka Alex Larson or Lex Larson, a self-proclaimed Hollywood insider who marketed himself as a rockstar turned producer. Shultz, also known as "Doc Hollywood," leveraged his background in music production and sync deals to position himself as a crypto advisor. Welch, likely unfamiliar with the intricacies of crypto, entrusted Shultz to manage her memecoin. Unfortunately, his involvement only exacerbated the chaos. Shultz’s lack of expertise, coupled with his focus on exploiting Welch’s fanbase, turned $HAWK into a textbook example of a rug pull.

The lesson from $HAWK is clear: celebrity-backed tokens often prioritize hype over substance, relying on fame to drive initial investment rather than delivering value or sustainability. Investors should approach such projects with extreme caution, as recognizable names and flashy marketing are no guarantees of trustworthiness or success. Whether it’s F-list celebrities like Shultz or established figures, these projects repeatedly highlight the risks of placing faith in individuals who lack the experience, transparency, or accountability to operate in the crypto space.

Why $TBALL Stands Apart in the Memecoin Space

As the backer of $TBALL, I’ve prioritized accountability and transparency as essential values in the crypto space—especially when it comes to memecoins. While $TBALL is a Super Utility Coin—the First AI-Powered Hybrid Meme-Utility Crypto for Payments—it retains its memecoin essence. So, what makes $TBALL different, and does my critique of projects like $HAWK make me a hypocrite? Let’s examine the distinctions.

The unchecked optimism surrounding projects like Sam Bankman-Fried’s FTX revealed the dangers of ignoring red flags—overhyped ventures plagued by mismanagement of funds, liquidity crises, and massive withdrawals. Similarly, $HAWK, led by Hailey Welch (a.k.a. the Hawk Tuah Girl), demonstrates the pitfalls of hyped but fundamentally weak projects.

While FTX represented systemic failure, $HAWK is a simplistic memecoin—just a few lines of code backed by the fleeting fame of a "meme girl."

Why $TBALL Is Rug-Proof

$TBALL mitigates the vulnerabilities that plague many other memecoins by prioritizing transparency, strong governance, and sustainable tokenomics. With a fixed token supply, $TBALL eliminates inflationary risks and creates stability based on organic supply and demand.

The project’s leadership team, fully doxxed and highly credentialed, brings unparalleled credibility and accountability, setting it apart from scam-prone memecoins. Furthermore, $TBALL is fully renounced, ensuring that the team does not control or benefit from any percentage of fees, unlike projects like $HAWK that siphon profits through opaque mechanisms.

$TBALL frequently draws parallels to Bitcoin, as there are clear similarities beyond their shared cryptocurrency DNA. While Bitcoin is the epitome of decentralization—no one knows the true identity of Satoshi Nakamoto, the largest Bitcoin holder, who has never sold a single token—$TBALL employs a comparable mechanism for releasing its fixed supply into the market. Like Bitcoin, which will see its last token mined around the year 2140, $TBALL’s supply grows alongside increased liquidity from organic market demand.

Two weeks ago, $TBALL reached a historic high of $12 million in market cap—a significant milestone that underscores its momentum and potential. While $TBALL isn’t comparable to $HAWK, a rug-pulled project, what sets it apart is its market cap, which is 35 times greater than Bitcoin’s approximately 3.5 months after its listing, when Bitcoin ranged between $277,600 and $347,000.

Furthermore, much like Satoshi Nakamoto, none of the $TBALL co-founders, insiders, or backers—including myself as the sole supporter through WEAL28H PRIVATE FUND—have sold a single token. Could we sell and walk away with millions? Absolutely. But such actions would not only compromise the integrity of the project but also undermine the credibility of the fully doxxed and highly credentialed team behind $TBALL. This team values their professional legacies and futures far more than the fleeting gains of a rug-pulled project. Trust, transparency, and a commitment to long-term value creation remain at the heart of $TBALL.

Our leadership team brings decades of real-world experience and professional credentials that speak to our ability to build something meaningful and sustainable. Unlike F-list celebrities or influencers in their early twenties, like $HAWK’s Hailey Welch, who lack the experience, foresight, and maturity to steward a project responsibly, we have a legacy to uphold.

Our team isn’t in this for fleeting fame or a quick payday but to establish a lasting framework for innovation and utility within the crypto space. Integrity is at the core of $TBALL, and our actions reflect that unwavering commitment.

Rather than relying on short-term hype, $TBALL integrates real-world utility through its AI-powered payment systems, standing out as a value-driven and innovative memecoin built for long-term sustainability and trust. Trust and innovation are not just goals—they are the core principles driving $TBALL’s success.

Redefining Memecoin Culture

Memecoins have long been synonymous with pump-and-dump schemes and speculative bubbles, leaving investors wary of the space. However, dismissing all memecoins as scams is like the skepticism surrounding the dot-com boom and bust of the late 1990s. After a wave of failures, many doubted the internet’s potential, but nearly 2.5 decades later, companies like Amazon and eBay have proven its transformative power.

Similarly, not all crypto projects are built on zero substance. $TBALL challenges this narrative by blending the fun and viral energy of memecoins with innovation, integrity, and utility. Where projects like $HAWK highlight the dangers of inexperienced leadership and undoxxed teams, $TBALL represents the future of what memecoins can and should be—a platform that prioritizes trust, utility, and long-term value creation.

Raising the Bar for Crypto

Criticizing scam-prone projects isn’t hypocrisy; it’s a necessary step in raising the standards for the entire crypto space.

Just as Wall Street isn’t defined by the Bernie Madoff Ponzi Scheme (2008) or the Enron Scandal (2001), crypto shouldn’t be dismissed as a playground for fraudsters and scammers.

Projects like $TBALL are proof that transparency and innovation can redefine the culture for the better. Memecoins don’t have to be synonymous with scams, and $TBALL is here to set the standard. It’s not just about changing the game—it’s about proving that crypto, like the internet, has the potential to revolutionize the world when built with integrity and purpose.

Looking Ahead: A World Beyond Speculation

The next four years will be pivotal for crypto. If Trump’s pro-crypto rhetoric translates into policy, the space could see unprecedented growth.

Bitcoin may very well double or triple in value, and new ventures—both legitimate and dubious—will undoubtedly emerge. But as the industry matures, the focus must shift from speculation to sustainability. Projects that prioritize transparency, utility, and community engagement will define the future of blockchain.

The critics who dismiss crypto as a passing trend are clinging to an outdated narrative. In a world driven by AI, blockchain, and digital innovation, those who fail to adapt risk being left behind. Crypto isn’t just a financial tool; it’s a technological evolution reshaping how we think about value, ownership, and trust.

For those who continue to conflate pro-crypto with political allegiance, let me be clear: my stance has always been about progress, not politics. The blockchain revolution transcends administrations and ideologies—it’s about creating a more inclusive, decentralized future. And that’s a future worth championing.

Coinbase got the Community Notes treatment for trying to brazenly gaslight their customers 🤣🤣🤣🤣🤣

Powerful! Right on when it comes to Coinbase! Those people are selfish and sick!