Crypto Market Manipulation: A Call to Action

Why the SEC Must Step In to Ensure Fairness and Transparency

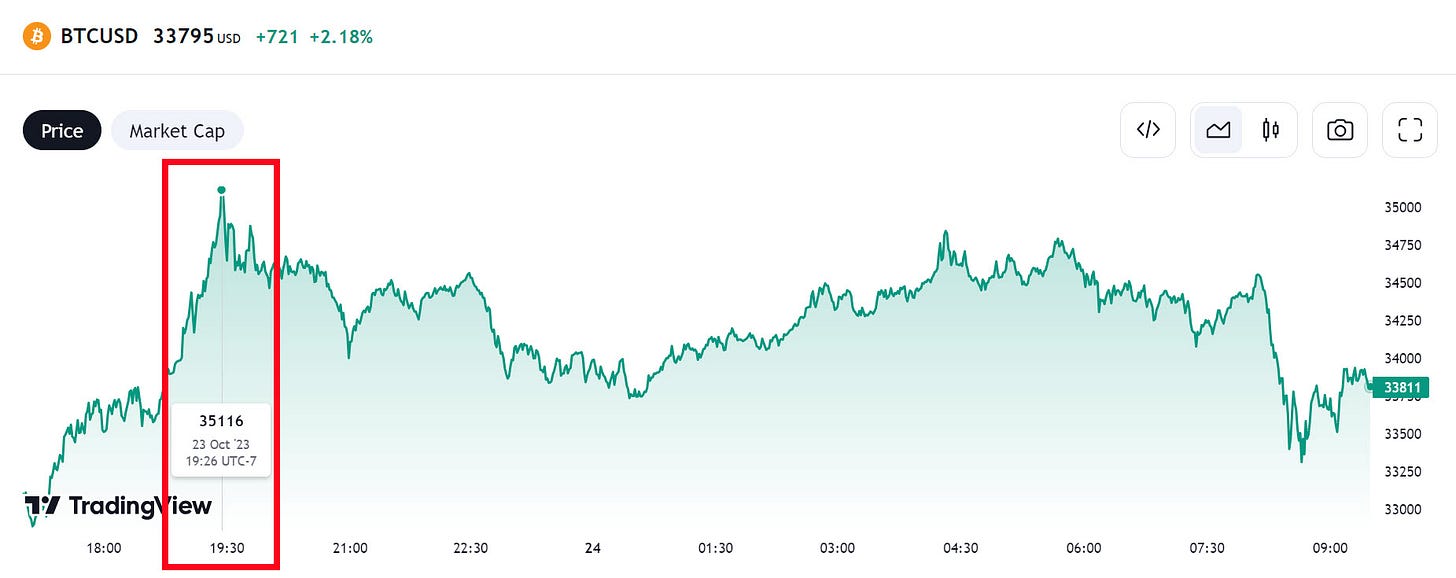

Here's a quick recap of the Bitcoin price surge that unfolded within less than 24 hours, driven by speculative manipulation and a rush of activity. In a dramatic turn of events around 19:26 UTC-7 (or 12:26 PM PST), Bitcoin experienced a significant surge in its value.

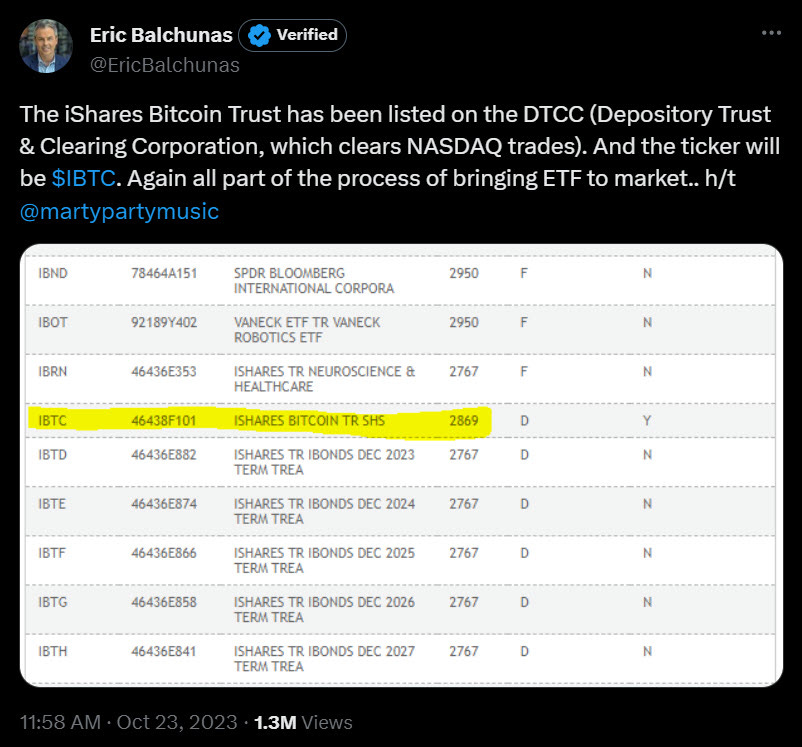

The catalyst believed to have triggered this rapid ascent was a tweet from Eric Balchunas, a Senior ETF Analyst at Bloomberg, posted at 11:58 AM PST. The tweet, which revealed that 'The iShares Bitcoin Trust has been listed on the DTCC (Depository Trust & Clearing Corporation, which clears NASDAQ trades). And the ticker will be $IBTC. Again all part of the process of bringing ETF to market.. h/t @martypartymusic,' has since gained attention with 1.3 million views. This development, a pivotal step in the ETF listing process, contributed significantly to the news dissemination across 'Crypto Twitter,' leading to a substantial increase in Bitcoin's value within minutes.

At 4:52 AM PST this morning, I put out a tweet on X (formerly known as Twitter) as follows:

𝐈’𝐦 𝐝𝐨𝐮𝐛𝐥𝐢𝐧𝐠 𝐚𝐧𝐝 𝐭𝐫𝐢𝐩𝐥𝐢𝐧𝐠 𝐝𝐨𝐰𝐧 𝐭𝐡𝐚𝐭 𝐭𝐡𝐞𝐫𝐞 𝐈𝐒𝐍’𝐓 𝐚𝐧𝐲 𝐜𝐡𝐚𝐧𝐜𝐞 𝐨𝐟 𝐚 𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐄𝐓𝐅 𝐚𝐩𝐩𝐫𝐨𝐯𝐚𝐥 𝐚𝐧𝐲𝐭𝐢𝐦𝐞 𝐬𝐨𝐨𝐧, 𝐞𝐯𝐞𝐧 𝐰𝐢𝐭𝐡 𝐁𝐥𝐚𝐜𝐤𝐫𝐨𝐜𝐤 𝐢𝐒𝐡𝐚𝐫𝐞𝐬 𝐨𝐛𝐭𝐚𝐢𝐧𝐢𝐧𝐠 𝐚 𝐂𝐔𝐒𝐈𝐏 𝐧𝐮𝐦𝐛𝐞𝐫, 𝐚 𝐭𝐢𝐜𝐤𝐞𝐫 𝐬𝐲𝐦𝐛𝐨𝐥, 𝐚𝐧𝐝 𝐛𝐞𝐢𝐧𝐠 𝐥𝐢𝐬𝐭𝐞𝐝 𝐨𝐧 𝐭𝐡𝐞 𝐃𝐓𝐂𝐂. These steps are part of the administrative and market readiness process. However, these steps are all 𝐍𝐎𝐓 mutually inclusive of one another as regulatory approval is a separate and MORE COMPREHENSIVE EVALUATION. These steps are distinct, and even if the administrative steps are completed, a REGULATORY REJECTION can STILL PREVENT the ETF from being listed and traded.

1) 𝐎𝐛𝐭𝐚𝐢𝐧𝐢𝐧𝐠 𝐚 𝐂𝐔𝐒𝐈𝐏 𝐍𝐮𝐦𝐛𝐞𝐫: A CUSIP (Committee on Uniform Securities Identification Procedures) number is a unique identifier assigned to financial securities, including ETFs, for tracking and administrative purposes. This administrative step, typically handled by CUSIP Global Services, is part of the preparation for an ETF's potential listing. It helps distinguish the security 𝐁𝐔𝐓 𝐃𝐎𝐄𝐒𝐍'𝐓 𝐆𝐔𝐀𝐑𝐀𝐍𝐓𝐄𝐄 𝐑𝐄𝐆𝐔𝐋𝐀𝐓𝐎𝐑𝐘 𝐀𝐏𝐏𝐑𝐎𝐕𝐀𝐋 𝐎𝐑 𝐋𝐈𝐒𝐓𝐈𝐍𝐆.

2) 𝐀𝐬𝐬𝐢𝐠𝐧𝐢𝐧𝐠 𝐚 𝐓𝐢𝐜𝐤𝐞𝐫 𝐒𝐲𝐦𝐛𝐨𝐥 — '𝐈𝐁𝐓𝐂': Ticker symbols are often alphabetical identifiers used for trading and tracking securities in the financial markets. Stock exchanges or data providers assign ticker symbols to securities. This step signifies market readiness 𝐁𝐔𝐓 𝐃𝐎𝐄𝐒𝐍'𝐓 𝐆𝐔𝐀𝐑𝐀𝐍𝐓𝐄𝐄 𝐑𝐄𝐆𝐔𝐋𝐀𝐓𝐎𝐑𝐘 𝐀𝐏𝐏𝐑𝐎𝐕𝐀𝐋 𝐎𝐑 𝐋𝐈𝐒𝐓𝐈𝐍𝐆.

3) 𝐆𝐞𝐭𝐭𝐢𝐧𝐠 𝐋𝐢𝐬𝐭𝐞𝐝 𝐢𝐧 𝐃𝐓𝐂𝐂: Being listed in the Depository Trust & Clearing Corporation (DTCC) is another preparatory step, 𝐁𝐔𝐓 𝐈𝐓 𝐀𝐋𝐒𝐎 𝐃𝐎𝐄𝐒𝐍'𝐓 𝐆𝐔𝐀𝐑𝐀𝐍𝐓𝐄𝐄 𝐋𝐈𝐒𝐓𝐈𝐍𝐆 𝐎𝐍 𝐀𝐍 𝐄𝐗𝐂𝐇𝐀𝐍𝐆𝐄. 𝐑𝐄𝐆𝐔𝐋𝐀𝐓𝐎𝐑𝐘 𝐀𝐏𝐏𝐑𝐎𝐕𝐀𝐋: Regulatory authorities, such as 𝐭𝐡𝐞 𝐒𝐄𝐂, conduct a comprehensive review of ETF applications. The purpose is to ensure the ETF's compliance with legal and regulatory requirements, market integrity, and investor protection. 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐚𝐩𝐩𝐫𝐨𝐯𝐚𝐥 𝐢𝐬 𝐞𝐬𝐬𝐞𝐧𝐭𝐢𝐚𝐥 𝐟𝐨𝐫 𝐥𝐢𝐬𝐭𝐢𝐧𝐠 𝐚𝐧𝐝 𝐭𝐫𝐚𝐝𝐢𝐧𝐠 𝐛𝐮𝐭 𝐝𝐨𝐞𝐬𝐧'𝐭 𝐠𝐮𝐚𝐫𝐚𝐧𝐭𝐞𝐞 𝐭𝐡𝐚𝐭 𝐚𝐝𝐦𝐢𝐧𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐯𝐞 𝐬𝐭𝐞𝐩𝐬 𝐥𝐢𝐤𝐞 𝐂𝐔𝐒𝐈𝐏 𝐚𝐬𝐬𝐢𝐠𝐧𝐦𝐞𝐧𝐭, 𝐭𝐢𝐜𝐤𝐞𝐫 𝐬𝐲𝐦𝐛𝐨𝐥 𝐚𝐬𝐬𝐢𝐠𝐧𝐦𝐞𝐧𝐭, 𝐚𝐧𝐝 𝐠𝐞𝐭𝐭𝐢𝐧𝐠 𝐥𝐢𝐬𝐭𝐞𝐝 𝐢𝐧 𝐃𝐓𝐂𝐂 𝐰𝐞𝐫𝐞 𝐜𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐯𝐞, 𝐀𝐒 𝐀 𝐑𝐄𝐉𝐄𝐂𝐓𝐈𝐎𝐍 𝐂𝐀𝐍 𝐎𝐂𝐂𝐔𝐑.

So, what's with the hoopla around #Bitcoin surging above $34,000 from trading sideways at $26,000 to $27,000?

It's simple:

𝐓𝐇𝐀𝐍𝐊𝐒 𝐓𝐎 𝐓𝐄𝐓𝐇𝐄𝐑 𝐏𝐑𝐈𝐍𝐓𝐈𝐍𝐆 𝐀𝐍𝐃 𝐁𝐈𝐍𝐀𝐍𝐂𝐄.

𝐌𝐚𝐧𝐢𝐩𝐮𝐥𝐚𝐭𝐞𝐝 𝐦𝐚𝐫𝐤𝐞𝐭𝐬 𝐝𝐢𝐬𝐩𝐥𝐚𝐲 𝐬𝐮𝐝𝐝𝐞𝐧 𝐬𝐡𝐢𝐟𝐭𝐬 𝐢𝐧 𝐝𝐢𝐫𝐞𝐜𝐭𝐢𝐨𝐧, and because Bitcoin and other cryptocurrencies often act more like religions, this fervent belief in their potential can lead to extreme market volatility.

Through market and price manipulation, misinformation spreads, driving more people in wanting to seek profits by contributing to the manipulation. 𝐒𝐮𝐜𝐡 𝐩𝐫𝐢𝐜𝐞 𝐦𝐨𝐯𝐞𝐦𝐞𝐧𝐭𝐬 𝐚𝐫𝐞 𝐮𝐬𝐮𝐚𝐥𝐥𝐲 𝐮𝐧𝐬𝐮𝐬𝐭𝐚𝐢𝐧𝐚𝐛𝐥𝐞 and can lead to 𝐬𝐢𝐠𝐧𝐢𝐟𝐢𝐜𝐚𝐧𝐭 𝐥𝐨𝐬𝐬𝐞𝐬 𝐟𝐨𝐫 𝐭𝐡𝐨𝐬𝐞 𝐅𝐎𝐌𝐎 𝐚𝐧𝐝 𝐞𝐧𝐝 𝐮𝐩 𝐠𝐞𝐭𝐭𝐢𝐧𝐠 𝐑𝐄𝐊𝐓!

𝐓𝐇𝐄 𝐒𝐄𝐂 𝐍𝐄𝐄𝐃𝐒 𝐓𝐎 𝐏𝐔𝐓 𝐀 𝐒𝐓𝐎𝐏 𝐓𝐎 𝐒𝐔𝐂𝐇 𝐌𝐀𝐃𝐍𝐄𝐒𝐒!

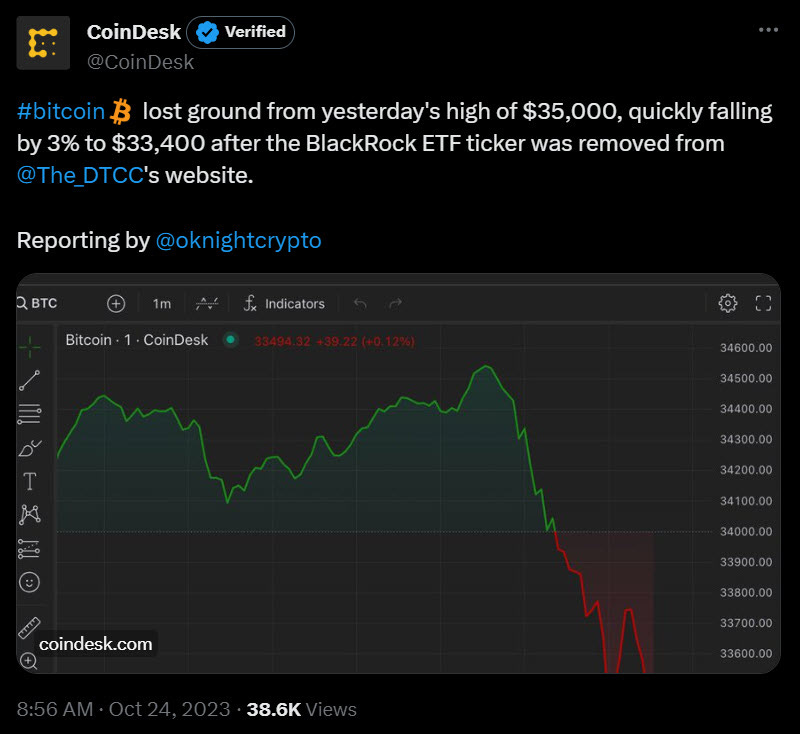

At 8:23 AM PST, @WhaleWire may have been the first to break the news via a Tweet on X/Twitter:

"𝐉𝐔𝐒𝐓 𝐈𝐍: 𝐓𝐡𝐞 𝐭𝐢𝐜𝐤𝐞𝐫 𝐟𝐨𝐫 𝐁𝐥𝐚𝐜𝐤𝐑𝐨𝐜𝐤'𝐬 𝐬𝐩𝐨𝐭 #𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐄𝐓𝐅, $𝐈𝐁𝐓𝐂, 𝐡𝐚𝐬 𝐫𝐞𝐩𝐨𝐫𝐭𝐞𝐝𝐥𝐲 𝐯𝐚𝐧𝐢𝐬𝐡𝐞𝐝 𝐟𝐫𝐨𝐦 𝐭𝐡𝐞 𝐃𝐓𝐂𝐂 𝐰𝐞𝐛𝐬𝐢𝐭𝐞."

At around 8:56 AM PST:

CoinDesk, Reuters, and numerous other crypto-related media networks published their reports following the removal of the BlackRock ETF ticker from the DTCC's website. This development led to a Bitcoin price drop to $33,400, as reported by CoinDesk.

The SEC's intervention is imperative to establish fairness and transparency in the ever-evolving realm of cryptocurrencies.

Unlike traditional markets, such as Wall Street, where there are numerous players, market makers, specialists, making it more challenging to swing assets by large percentages, 𝐭𝐡𝐞 𝐜𝐫𝐲𝐩𝐭𝐨 𝐦𝐚𝐫𝐤𝐞𝐭 𝐝𝐨𝐦𝐢𝐧𝐚𝐭𝐞𝐝 𝐛𝐲 𝐨𝐧𝐥𝐲 𝐚 𝐟𝐞𝐰 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐚𝐧𝐝 𝐞𝐱𝐜𝐡𝐚𝐧𝐠𝐞𝐬, 𝐫𝐞𝐦𝐚𝐢𝐧𝐬 𝐬𝐮𝐬𝐜𝐞𝐩𝐭𝐢𝐛𝐥𝐞 𝐭𝐨 𝐦𝐚𝐧𝐢𝐩𝐮𝐥𝐚𝐭𝐢𝐨𝐧. Furthermore, a significant portion of crypto investors lacks the expertise seen in traditional markets, often following the crowd, succumbing to FOMO, and facing substantial losses. These undesirable attributes, such as susceptibility to manipulation of the crypto space underscore the critical need for regulatory oversight to protect the interests of all participants.

I heard there was another ticker granted today and also listed, but thanks Jenny, this information really helps us understand the process.

Crypto wouldn't be crypto if market manipulation isn't at the forefront.