Cryptocurrency's Shifting Tides: The Tether Transition and SEC Speculations

A Deep Dive into the Tether CEO Transition, SEC Investigations, and the Ripple Effect in the Crypto World

Part 1: Introduction — Intrigued by the Cryptocurrency World

With my background as a former Wall Street Investment Banker, Market Maker and Market Analyst, my profound enthusiasm for dissecting financial trends, market movements, and navigating the intricate terrain of legal intricacies tied to financial regulations by entities such as the SEC, FINRA, and other regulatory authorities has been an intrinsic part of my identity. While I'm not an attorney, having founded two investment banking firms from the ground up without the need of any legal advice or assistance from attorneys, my strengths in this area have been deeply rooted for over two decades, granting me a unique set of skills. These skills blend the legal perspective of professional attorneys with my extensive experience in specialist analyst roles on Wall Street, where I provide expert insights and recommendations, contributing to a comprehensive understanding of the intricate world of finance and regulation.

Part 2: Introduction to Cryptocurrency Expertise — Navigating the Cryptocurrency Universe

From the SEC's pivotal decisions to enigmatic leadership shifts in the cryptocurrency realm, I've remained deeply ingrained in this ever-evolving financial universe where the forces of money hold significant sway. These are the narratives that consistently engage our attention, mold the contours of our financial landscapes, and, at times, present puzzles that intrigue us to no end.

Part 3: Early Predictions — Predicting the SEC's Decision on Grayscale

Throughout my journey in the crypto space since 2015-16, I've consistently offered insightful and well-documented perspectives, widely shared across social media platforms like X (formerly Twitter) and Instagram. On Friday, October 13, while most of 'Crypto Twitter' was awaiting the SEC's decision regarding their case against Grayscale, I was the first to make an early call, predicting that the SEC would opt NOT to appeal their case against Grayscale. This foresight was detailed through my Substack publication, 'Crypto Unleashed: SEC's Grayscale Spot Bitcoin ETF Call and Tether's Paolo Ardoino's CEO Shift Amid Legal Turbulence.' This prediction hit the mark precisely later that afternoon.

Part 4: Transition at Tether — Unraveling the Mystery: Transition at Tether

Now, as I've been asked and as I’m also intrigued enough to turn my attention to a new and early forecast regarding the most recent enigma in the crypto world - the transition at the helm of Tether. This transition has raised eyebrows and ignited discussions about the underlying reasons for this significant shift.

Part 5: Tether's Management Secrecy — The Unusual Secrecy of Tether's Leadership

Taking a step back, as reported by Bloomberg, Stuart Hoegner, Tether's attorney, highlighted the inclination of both Jean-Louis Van der Velde, who co-founded Bitfinex in early 2013 and established the holding company, DigFinEx, and Giancarlo Devasini, who has served as the CFO for both Bitfinex since 2012 and later at Tether, to maintain a low public profile. The WSJ article, titled 'The Unusual Crew Behind Tether, Crypto’s Pre-Eminent Stablecoin,' discussed how Tether's unusually high level of secrecy shrouds a cryptocurrency with an $83 billion market capitalization, third only to Bitcoin and Ethereum. This peculiarity has led to Paolo Ardoino being the sole public face for both Bitfinex and Tether since 2017, while serving simply as the CTO. Van der Velde welcomed Paolo Ardoino to Bitfinex in 2014, and Ardoino subsequently joined Tether as the CTO before officially assuming the CEO role only last Friday.

Part 6: Giancarlo Devasini — The Role of Giancarlo Devasini

Then, there's Giancarlo Devasini. According to the Financial Times, he ventured into cryptocurrencies in 2012 and subsequently assumed the role of Chief Financial Officer at Bitfinex, a prominent exchange, and Tether, its sister currency. Industry insiders assert that he holds the pivotal decision-making role at both these companies, which collectively boast a current market capitalization of $83.66 billion dollars, as reported by the Financial Times.

Part 7: The Million-Dollar Question — Uncovering the Timing of Transition

So, the million-dollar question is, why now? Why during one of the most challenging years in the world of cryptocurrency, marked by events such as the collapse of LUNA and UST, the bankruptcy of 3AC, BlockFi, and Voyager, the upheaval of Sam Bankman-Fried and FTX, the troubles faced by Celsius, a 90% price crash, banking woes, USDC's depegging, over $1 billion worth of crypto hacks, the US government and SEC's actions against Binance and Coinbase, the longest sideways price action since the birth of Bitcoin in its fifteen-year history, and delays in Bitcoin Spot ETFs?

Part 8: Tether's Media Move — The Strategy Behind Tether's Transition

Why now is the perfect time for Tether's management to decide to embark on a PR campaign to change management during this tumultuous time when nothing had changed for the past DECADE with Jean-Louis van der Velde being CEO to now stepping down to an advisory role, with Paolo Ardoino taking on BOTH roles CTO and CEO? Doesn’t this move place the company in the 'eye of the media storm' at a time when most should choose to remain in the background with lesser noise and attention? It's a decision that raises questions, particularly when contrasted with other prominent figures like Tom Brady, Mark Cuban, and Kevin O'Leary. These figures have been deeply entwined with the promotion of major collapses in the crypto fintech realm this year, seemingly attempting to evade scrutiny and any connections to the companies they heavily endorsed, all while reaping substantial financial rewards. Why is Tether willingly stepping into the 'media spotlight' during a turbulent period when most would prefer to keep a lower profile with less attention?

Part 9: CEO Transition in Cryptocurrency — CEO Transition in Cryptocurrency: A Complex Affair

In normal circumstances, when a CEO steps down, it can make folks nervous for a few reasons. First off, it leaves a kind of "who's in charge?" question hanging in the air, which can be unsettling. Investors might get jittery because they like stability, and a change at the top can ruffle feathers. Plus, it can affect the mood in the company - employees often look up to the CEO for leadership, and when they leave, it can be a bit of a buzzkill. And if the departure isn't smooth or seems abrupt, that can raise eyebrows. But hey, sometimes a new CEO can bring in fresh ideas and help a company out of a rough spot. It all depends on the situation and how well the transition is handled. However, when a CEO steps down amid ongoing concerns or controversies, as is the case with the current crypto landscape, it can fuel suspicions of an attempt to conceal past wrongdoing. This situation is particularly pronounced in the case of Tether, which has been a subject of controversy since its inception due to its unconventional management practices. Such actions can erode trust and transparency in the company's operations, leaving the public with unanswered questions about accountability and responsibility.

Part 10: Speculations of SEC Investigation — Could Regulatory Bodies, Including the SEC, Be a Factor?

Let’s take a step further, as I raised the question, “Is there a possible pending SEC investigation or lawsuit that forces Ardoino to confront these challenges head-on by being CEO” in my last Substack, and here’s why. There’s a saying often attributed to Alexander Pope, “If we suspect that a man is lying, we should pretend to believe him; for then he becomes bold and assured, lies more vigorously, and is unmasked.” Additionally, "Three may keep a secret if two of them are dead," often attributed to Benjamin Franklin. If the SEC has indeed already sent a letter to Bitfinex and Tether to request information as part of an investigation before making any public announcement about the investigation or potential legal action, it is often referred to as a "Wells Notice." A Wells Notice is a formal communication from the SEC to inform the recipient that the SEC is considering recommending enforcement action against them. The recipient is typically given an opportunity to respond to the notice and provide information or arguments in their defense before the SEC proceeds with any public announcement or formal legal action. The Wells Notice process is part of the SEC's efforts to ensure due process and fairness in its enforcement actions.

If this had in fact happened, then it would make sense for the Tether team to make a transition NOW giving Paolo Ardoino the full authority as acting CEO to answer directly with the SEC.

While true, the response to a Wells Notice or any request for information from the SEC does NOT have to come directly from the CEO of a company. In many cases, the SEC may request information from various individuals within the company, depending on the nature of the investigation and the specific issues being examined. This could include responses from legal counsel, compliance officers, financial officers, or other relevant personnel who have knowledge of the matter under investigation. The SEC has the authority to request responses and documents from specific personnel within a company during investigations. In the case of Bitfinex and Tether, if the decision to have a CEO resign to avoid being questioned during an investigation, if that is the case, at least for a period of time, is a possible strategy that individuals may employ to delay or potentially avoid answering questions. Therefore, it would be best to have all responses come from Paolo Ardoino, as "It's better to have one person do the talking than to have a whole group singing different tunes." This approach involves keeping both Van der Velde and Devasini behind the scenes until they are subpoenaed, if so, which is a legal order issued by a court that requires an individual to appear and testify as a witness or to produce specific documents or evidence. Failure to comply with a subpoena can result in legal consequences, including fines or even contempt of court charges.

As I had also stated in my last Substack, "Jean-Louis Van der Velde may have WISELY stepped down as CEO to reduce his legal exposure, although that may not release him from any liabilities up through this point." A CEO can indeed resign from their position and no longer hold that title, but that does NOT necessarily absolve them from potential legal obligations, including cooperating with investigations. Legal authorities, such as the SEC, can still request information and testimony from former executives if they believe those individuals have relevant information regarding alleged misconduct or violations. Refusing to cooperate with such requests can have legal consequences, including the possibility of being compelled to testify by a court order. Resigning from the CEO position does NOT automatically grant immunity from questions or investigations. Non-compliance with lawful requests can result in legal penalties and further complications.

Part 11: Ardoino's New Role as CEO — Ardoino's Take on the Transition

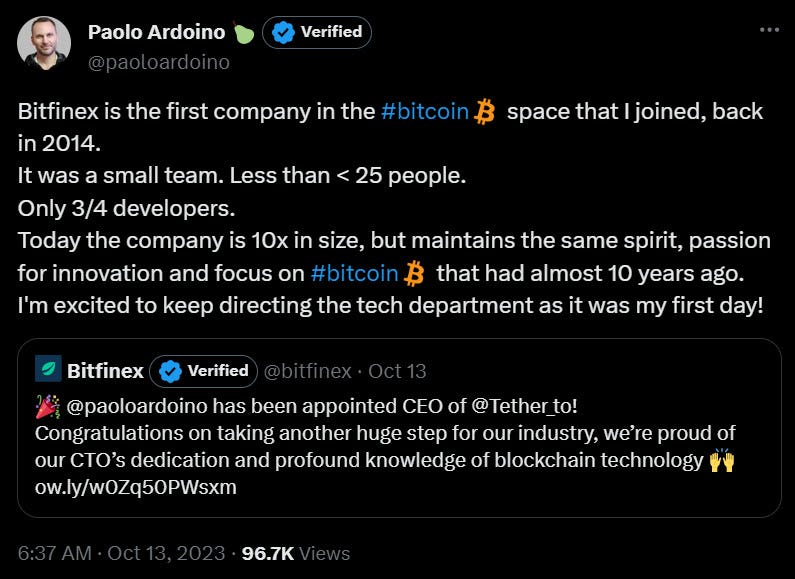

On the day of his promotion, Paolo Ardoino tweeted, 'Bitfinex is the first company in the Bitcoin space that I joined, back in 2014. It was a small team, less than 25 people, with only 3/4 developers. Today, the company has grown tenfold, yet it maintains the same spirit, passion for innovation, and focus on Bitcoin that it had almost a decade ago. I'm excited to continue leading the tech department, just as I did on my first day.' Now, being a 3x founder, an active investor/VC, mentor, and advisor to countless companies, my expertise tells me that if a company has genuinely experienced tenfold growth, it's more common for the roles to expand rather than consolidate. With such significant growth as Paolo Ardoino has claimed, shouldn’t there be typically more complex responsibilities, and having two people in these roles, each with a specific focus, can be a more effective way to manage the increased demands? This allows for more specialized attention to different aspects of the business and a clearer division of responsibilities. So, in the context of substantial growth, expanding the CEO and CTO roles to two individuals with distinct areas of focus is often a logical and practical choice than going from two separate high-ranking roles down to one? That is UNLESS the strategy is 'It's more effective to have a single spokesperson than a chorus of conflicting voices.'"

Part 12: The Transition at Tether — Examining the Transition at Tether

Tether, the stablecoin giant, has long been a pivotal player in the cryptocurrency universe, but the winds of change have swept through its leadership, and Paolo Ardoino, the Chief Technology Officer (CTO), has taken the helm as CEO. This change, occurring amid legal turbulence and ongoing investigations within the crypto space, has naturally raised eyebrows and stirred speculation. Is it a strategic response to legal pressure, an attempt to navigate the uncertain waters of regulatory scrutiny, or something entirely different?

In a crypto space that continues to be one of the wildest, manipulative, and largely unregulated arenas, this morning's incident serves as a stark reminder of the volatility and unpredictability inherent in the world of cryptocurrencies. It highlights the pressing need for stringent and swift regulatory interventions to ensure transparency and accountability. Just this morning, Cointelegraph, one of the leading crypto media outlets, issued an apology: 'We apologize for a tweet that led to the dissemination of inaccurate information regarding the Blackrock Bitcoin ETF. An internal investigation is currently underway. We are committed to transparency and will share the findings of the investigation with the public once it is concluded within 3 hours.' This event briefly sent Bitcoin's price skyrocketing from being under $27,000 to over $30,000 in some exchanges in a matter of hours.

As the crypto world weaves through these turbulent times, Tether's leadership transition is another bewildering element in an already convoluted puzzle. Such unorthodox decision-making not only fails to provide clarity but also amplifies the growing skepticism surrounding trust and investor confidence in the crypto space. This situation could potentially result in a far-reaching catastrophe, surpassing the current challenges faced by FTX.

Extra Part: On a Similar Note — Examining High-Profile Figures and Their COMPLICITY in Crypto Blown-Ups

I recently participated in another Twitter Space session alongside attorney John Reed Stark on Saturday, October 14, where we engaged in discussions on various crypto-related topics. During our conversation, we discussed various crypto-related topics, and I'd like to highlight some key insights from that discussion, not in any particular order of time from the Space:

You can access the full Twitter Space recording [here].

Decoding Section 17(b) of the Securities Act of 1933: Understanding Complicit Promotion of Securities

From the above embedded video with specific clips, the audio has been accelerated to 1.5x speed, beginning at 39:28, attorney John Reed Stark provided insights into Section 17(b) of the Securities Act of 1933, which is a crucial legal provision in the United States. This section pertains to the compensation of individuals or entities for promoting or touting securities. In essence, Section 17(b) mandates that anyone, including CELEBRITIES, INFLUENCERS, PR FIRMS, MARKETING AGENCIES, OR OTHER ENTITIES, who receives compensation for endorsing a security MUST disclose this compensation. The disclosure should include details about the compensation amount and the nature of the relationship with potential investors. This provision's primary purpose is to ensure transparency, prevent misleading or fraudulent promotions within the securities market, and protect the interests of investors.

You can read John’s opinion piece about this topic published in The New York Times titled 'Celebrity Crypto-Hawkers Should Get a Close Look.'

Questioning Crypto Complicity

At 38:35, I raised a question with attorney John Reed Stark regarding the complicity of crypto promoters. I specifically mentioned individuals such as Kim Kardashian, who was fined by the SEC for unlawfully promoting a crypto security and subsequently agreed to settle the charges by paying $1.26 million in penalties, disgorgement, and interest for promoting Ethereum Max. This discussion also touched on figures like Ben "BitBoy" Armstrong, a crypto influencer who could face fines or prison if convicted according to Cointelegraph.

A Journey Through the Crypto Space

From 12:35 to 21:00, I engaged in a discussion with fellow participant 'Not Tiger Global' regarding the delay in regulatory actions against individuals such as CZ of Binance. Through insights from my professional network on Wall Street, including experts in financial regulations and litigation, I've learned that the legal process, including agencies like the SEC and the Department of Justice, follows a methodical approach when dealing with crimes related to cryptocurrencies. Investigations require time for collecting evidence, addressing international legal issues, and maintaining confidentiality to build strong cases. Cryptocurrency-related crimes are particularly intricate due to the anonymous nature of certain cryptocurrencies and the necessity for cooperation between different countries' authorities. The legal system prioritizes fairness and protecting individuals' rights, which can extend the process to ensure justice. The international legal system enables the United States to collaborate with other countries in pursuing individuals involved in cross-border crimes through extradition treaties and Mutual Legal Assistance Treaties (MLATs).

Insights from participant ‘I Stand with Ukraine’

From 21:05 to 36:41, we had 'I Stand with Ukraine' sharing his experiences and insights. “I Stand with Ukraine” offered a unique perspective, shedding light on several critical topics. The conversation touched upon the distinction between cryptocurrencies as securities rather than utilities, a viewpoint he shared with attorney John Reed Stark. The conversation continued with valid concerns about the involvement of influential figures in the crypto space, such as Brian Armstrong, the CEO of Coinbase, and Mike Novogratz, who leads Galaxy Investment Partners, a cryptocurrency investment firm. These influential figures have been criticized for their potential focus on personal gains over the best interests of the broader crypto community.

The conversation also delved into the involvement of traditional venture capital firms such as a16z and well-known legal entities like Sullivan & Cromwell, which have a significant presence in the crypto space. These entities often serve as advisors to transactional attorneys working on various crypto projects, as well as defense attorneys when these projects face legal issues. The discussion unveiled how these professionals profited excessively from the crypto landscape, charging exorbitant sums, sometimes in the hundreds of millions of dollars, in legal fees. These funds were sourced from investors or, in more unfortunate cases, the victims of these projects.

Exploring Regulatory Delays

At 30:46, attorney John Reed Stark shared a vivid example from Sullivan & Cromwell, where an attorney's actions assured investors everything was fine just four days prior to the FTX collapse, raised questions about the ethics and integrity of legal representatives in the crypto sphere, potentially leading to severe consequences for customers.

Exposing Scams and Advocating for Regulation

Starting from 0:00 to 12:30, I recounted my journey in the crypto space, torn between opposing bad actors and supporting the crypto industry. I shared my experiences within the Dogecoin community in 2021, where I exposed various rug pulls, potentially saving numerous investors from falling victim to scams. I also discussed my anticipation of potential issues in platforms like Coinbase, connected to the stablecoin USDC, and Tether, which could lead to the implementation of necessary regulations, including AML/KYC requirements, to establish cryptocurrencies as legitimate assets for investment and meaningful project development using blockchain and smart contracts.

Absolutely a great read. My favorite part: Now, being a 3x founder, an active investor/VC, mentor, and advisor to countless companies, my expertise tells me that if a company has genuinely experienced tenfold growth, it's more common for the roles to expand rather than consolidate.

Absolutely my most favorite part, Jenny: " if a company has genuinely experienced tenfold growth, it's more common for the roles to expand rather than consolidate "