Diverging Perspectives: A Professional Debate with Jake Donoghue from Our Twitter Conversations

Can the Evolution of Blockchain and Cryptocurrency Overcome Skeptics?

When it comes to cryptocurrencies and blockchain technologies, skepticism and caution are just as evident. Despite the revolutionary potential that blockchain presents, doubts remain high among those who are wary of its implications.

Blockchain technology was first outlined in 1991 by researchers Stuart Haber and W. Scott Stornetta, who aimed to create a system that prevented tampering with document timestamps. Fast forward to 2008, when Satoshi Nakamoto’s whitepaper introduced Bitcoin, the first practical application of blockchain technology. Designed to function as a decentralized, peer-to-peer cryptocurrency without reliance on a central bank, Bitcoin’s blockchain acts as the engine driving its ledger, recording transactions in a decentralized, distributed manner that resists tampering and eliminates the need for third-party authentication.

The size of the Bitcoin blockchain has grown exponentially, reflecting its widespread adoption. Beyond Bitcoin, blockchain's potential extends into various industries—financial, educational, manufacturing, and healthcare among them. With the launch of Ethereum in 2015, blockchain technology expanded its capabilities, allowing not just the recording of currency transactions but also the management of assets like contracts and loans.

Despite these advancements, there are those who continue to question the value and sustainability of these innovations, preferring the comfort of traditional systems.

On August 13, I dropped into an X Space (formerly Twitter Spaces) hosted by Jake Donoghue and co-hosted by Molly White, with speaker guests Dan Davies and Andrew Chow. The overall discussion was informative, though I couldn’t help but notice a sentiment that seemed to lean towards a mix of anti-bad actors and possibly anti-crypto.

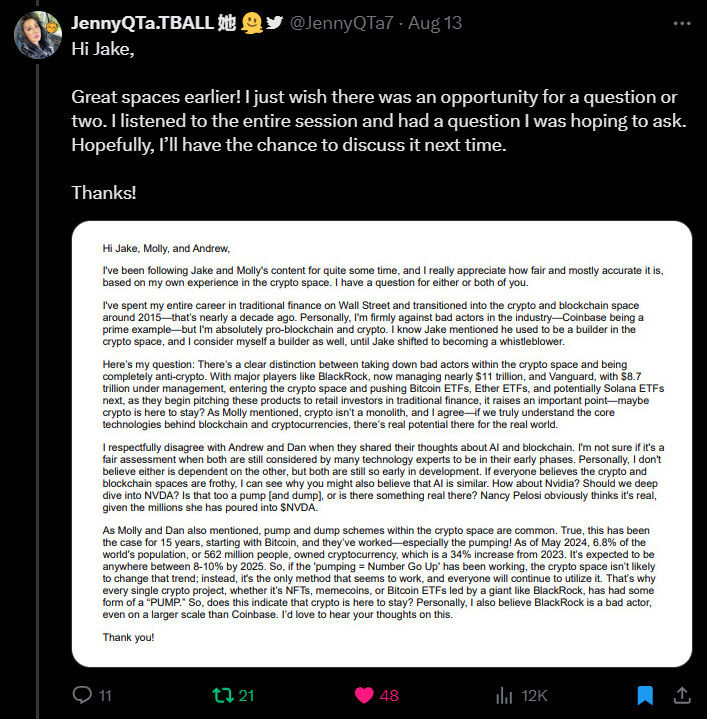

I raised my hand to speak but didn’t get the opportunity, as the host mentioned there wasn't enough time for additional comments. Instead, I tweeted a reply to the host, co-host, and their guests.

A week later, Jake Donoghue responded to my tweet and asked for my thoughts. [https://x.com/JDonoghueAuthor/status/1825308298465157551]

Here are my responses to Jake's replies, broken down one paragraph at a time.

Jake's Paragraph:

"Firstly, it's great to hear that you're against bad actors in the industry. After having worked deep in the space for a long time, and met so many people with skewed moral values / outright scammers, I am now firmly on the sceptic side. Anything that can be done to clean up crypto, remove bad actors and hold them to account, and protect retail investors who are the predominant victims of crypto fraud, is an inherently good thing."

Response:

Absolutely, Jake. Protecting retail investors and cleaning up the space are top priorities. It's unfortunate that the actions of a few have led to widespread skepticism, but I believe this is an opportunity for us to redefine the industry’s standards and ensure that transparency and integrity become the norm. We're on the same page about the need to hold bad actors accountable to restore trust in crypto. However, it’s challenging to convince naysayers and non-believers that the industry has turned the corner, especially when their skepticism is deeply ingrained. It’s like trying to convince someone that a once notorious neighborhood has transformed into a thriving community—they often only see what they remember, not the changes that have taken place. But if the chances by these naysayers and non-believers are given, they might just witness the evolution firsthand and realize that the industry is capable of moving beyond its past.

Jake's Paragraph:

"As for whether crypto is here to stay, it certainly seems like there's no sign of it going away in the short term. It has proven remarkably resilient over the years to highly catastrophic blow-ups. While that is a risk factor moving forwards, I think a bigger risk is continuous sideways movement."

Response:

You're right, Jake—crypto's resilience has been nothing short of remarkable. While sideways movement is a concern, I see it as part of the natural ebb and flow that all emerging technologies experience. These quieter periods often serve as crucial times for innovation and laying the groundwork for the next wave of growth. If we look back at the dot-com era, we see a similar pattern: an initial explosion of excitement, followed by a period of disillusionment where many companies failed, and scams were rampant as well. However, out of that turbulence, some of the most powerful and enduring tech companies emerged, like Amazon and Google. The same was true for the early days of the automobile and electricity industries—both faced their fair share of skepticism and fraud, but ultimately, they revolutionized the world.

Crypto may be experiencing a similar cycle, where the hype is settling, but the true innovators are quietly building the future. Just as the dot-com bust paved the way for the internet giants we rely on today, this period of consolidation could be setting the stage for the next generation of blockchain and crypto advancements.

Jake's Paragraph:

"The industry thrives on volatility and publicity; whether positive or negative. Without that, it risks petering out and masses of holders may lose interest and pivot into new industries / narratives (have we already started to see this with AI?). Currently, I believe crypto is at risk of losing the drama, and the perception of being 'cool' and subversive, which drove most people to it in the first place."

Response:

I can see where you're coming from, Jake. The volatility and 'cool' factor have definitely played significant roles in drawing attention to crypto. However, I believe this evolution—where the noise dies down—is actually a sign of the industry maturing. Much like with AI, the transition from hype to utility is where the true value is realized. The shift might feel less exciting on the surface, but it paves the way for more sustainable growth and meaningful adoption.

Jake's Paragraph:

"I believe that it will always survive in some form or another - much like how some people still trade penny stocks - however it very much feels like the industry has had its heyday. The chance for 'mass adoption' came in the last cycle, with huge brands and huge corporates all clamouring to get exposure to crypto, and the industry blew up and didn't rise to the opportunity. Now, it's difficult to see how it can ever achieve mass traction, as it's so synonymous in the minds of most with fraud and malpractice."

Response:

Jake, when you ask, "how can it ever achieve mass traction?" the answer is simple: since the rise and fall of FTX in 2021-2022 and the downfall of SBF, Bitcoin and Ethereum have now funneled themselves through traditional finance channels, particularly with retail investors. As of July 22, 2024, global listed crypto ETFs and ETPs had a total of $65.97 billion in assets for Bitcoin and $116 million in net new assets for Ethereum. This represents a significant accumulation of assets in a short period since the approval of the Bitcoin ETF in January 2024 and the Ethereum ETF in May 2024.

I wouldn’t call $66 billion chump change, and that’s only been since January 10, 2024, when the Bitcoin ETF was approved (Ethereum's ETF was just approved on May 23, 2024).

Additionally, you might have heard that BlackRock and Citadel Securities are among the investors backing a group seeking to start a new national stock exchange in Texas, with BlackRock's $10 Trillion Tokenization Vision: The Future Of Real World Assets.

You can read more of my thoughts about BlackRock and security tokens in my prior Substack post: Pro-Crypto, Anti-Bad Actors: Crypto’s Balancing Act.

So, Jake, while it's true that the last cycle was a significant test for crypto, I wouldn't say the opportunity for mass adoption has passed. Rather, it exposed the industry's growing pains and highlighted areas for improvement. Yes, the association with fraud is a hurdle, but I see it as a call to action for those committed to driving real innovation. With the right focus on transparency and practical applications, I believe there’s still immense potential for crypto to regain and even surpass its former momentum.

Jake's Paragraph:

"Of course, the institutions are launching ETFs. However, I'm not sure this is as bullish a sign of mass adoption as many would proclaim; these firms just want fees, and are more than happy to act as facilitators and product vendors for just about anything which will bring them revenue. They are highly unlikely to ever adopt blockchain tech into their business operations, so the ETFs merely reinforce the point of crypto existing predominantly as a speculative asset, without much real use."

Response:

I agree, Jake, that institutional interest, particularly through ETFs, is driven by profit motives rather than a belief in crypto’s transformative potential. But isn't that the same with traditional finance, like Wall Street? Take hedge funds, for example—they often invest in sectors they believe will yield the highest returns, regardless of whether they fully embrace the underlying technology or industry. This doesn’t diminish the value of those sectors; rather, it reinforces their potential profitability.

Shouldn't this reassure the crypto space that because these financial giants are now tapping into crypto, they're definitely here to stay?

The very fact that these institutions see value in crypto as a speculative asset indicates its staying power. While it may seem limited to speculation now, I believe that as more practical use cases emerge and mature, the broader adoption of blockchain technology—even by these institutions—will follow. It's a gradual process, but one that could shift perceptions over time.

Jake's Paragraph:

"And it's in this area that I see crypto continuing to exist; as an asset class which attracts gamblers and speculators. I don't believe crypto has any real use, or actually makes anything better. I've often said it's a solution to a problem which does not exist. However, for gamblers and people who need to avoid the traditional banking system (people committing crimes, basically), crypto will always be a valuable tool."

Response:

I respect your perspective, Jake, though I view it a bit differently. While speculation is a significant part of the current landscape, I believe we're just beginning to scratch the surface of crypto's potential beyond that. From decentralized finance to cross-border payments and digital identity solutions, the real-world applications are growing. It’s understandable to be skeptical given the current state of things, but I see crypto as a technology still in its infancy, with much more to offer as it matures.

And Jake, don't you think Wall Street is also made of gamblers and speculators? Some of the largest figures in traditional finance have been involved in notorious financial crimes—take, for instance, "The Unlucky Gambler: Richard Whitney," "The Market Manipulator: Ivan Boesky," "The Junk Bond King: Michael Milken," and "The Financial Statement Fraudster: Bernard Ebbers" (source: Investopedia). Not to mention Hollywood’s depiction in the original Wall Street (1987), where the main financial crime was insider trading, with Gordon Gekko (played by Michael Douglas) as the unscrupulous corporate raider and Bud Fox (Charlie Sheen) as the novice stockbroker. In the movie, Fox spies on executives to gain inside information for Gekko's stock trades, ultimately leading to his arrest by the SEC.

What do we call all of these from traditional finance? Gamblers and speculators, just like the ones we see in crypto today.

The point is, speculation isn’t unique to crypto—it's a longstanding element of traditional finance as well. As crypto matures, I believe we’ll see its potential extend far beyond the speculative, into real-world applications that will truly transform industries.

Jake's Paragraph:

"I know you're in the industry, and this may not be the answer you were looking for, however it's my honest opinion. Happy to hear your thoughts on it. I'm planning another Spaces soon, and as discussed would love to bring you on to debate this topic further. I think a frank exchange of differing views is always of tremendous benefit."

Response:

As you scroll through my Substack, you'll see that I am definitely anti-bad actors, and I've been following this space and know who's who for nearly a decade. Do I still believe there are plenty of bad actors left in this space? Most definitely, and I've been outspoken about calling them out.

Do I believe there will be more cases like SBF and FTX? Oh, most definitely, and they might even be larger. Do I believe Bitcoin isn't what it's been touted to be and has only been pumped and manipulated by bad actors, most of whom we call Bitcoin maxis? Oh, most definitely.

But will these potentially huge problems shut down innovations that could revolutionize the next wave of financial markets?

I don't think so.

In fact, Wall Street is even considering turning its traditional 6:30 AM to 1 PM PST trading hours—unchanged for decades—into 24-hour market exchanges similar to cryptocurrencies. Why? Because they see the huge money to be made (as you know, you call them gamblers and speculators, so Wall Street is likely to make it 24 hours to let more gamblers and speculators get in the game more easily).

This move wouldn’t shut down crypto; it would further enhance it, paving the way for the next generations who will continue evolving cryptocurrencies and blockchain long after we're gone from this planet. Critics of the internet, emails, and text messaging were proven wrong within 30 to 40 years, I believe, and I think the same will be true for crypto and blockchain.

I appreciate your honesty, Jake, and I value this kind of candid discussion. It's through open and frank exchanges that we can all learn and grow, and I'm looking forward to continuing this conversation. I’d be delighted to join your next Spaces to dive deeper into these topics. Our differing views can indeed spark some valuable insights for the community. Thank you for your professionalism and for fostering such a thoughtful dialogue.

Great read! Nicely done!

Might even be shorter, the internet were proven wrong over the past 20-30 years.