The PR Conundrum: Does Every Publicly Traded Company Need an External Firm, and Who Benefits?

Unraveling the Complex Dynamics of Corporate Communications

On September 5th, I tweeted, "When 'Press Releases' 𝙖𝙧𝙚 important, as they come 𝙙𝙞𝙧𝙚𝙘𝙩𝙡𝙮 from the company, as PR 'pumps' are not needed." This seemingly straightforward statement sparked a wave of discussions about the role of public relations (PR) in the corporate world. It's a topic that's been hotly debated for years, and one that holds particular intrigue when it comes to publicly traded companies.

Being a Wall Street veteran, former analyst, and market maker, I have hands-on experience with how publicly traded companies disseminate news. They employ various avenues such as press releases, in-house PR teams, or communications teams that liaise directly with the media. Some also engage external PR firms to bolster their communication efforts and provide additional resources.

Today, let's delve deeper into how publicly traded companies may inadvertently do PR firms a favor due to their publicly traded status and the unique dynamics of Wall Street. This fascinating interplay between publicly traded companies, Wall Street analysts, and the media sheds light on a facet of PR that often goes unnoticed.

In my previous article, "Is Your Startup Ready For Professional PR?" published on Sep 9, 2022, via Entrepreneur.com, I explored the comprehensive realm of public relations and its pivotal role in magnifying a startup's message. Today, we shift our spotlight onto publicly traded giants and scrutinize whether each of them truly requires the services of an external PR firm and who reaps the rewards if they do.

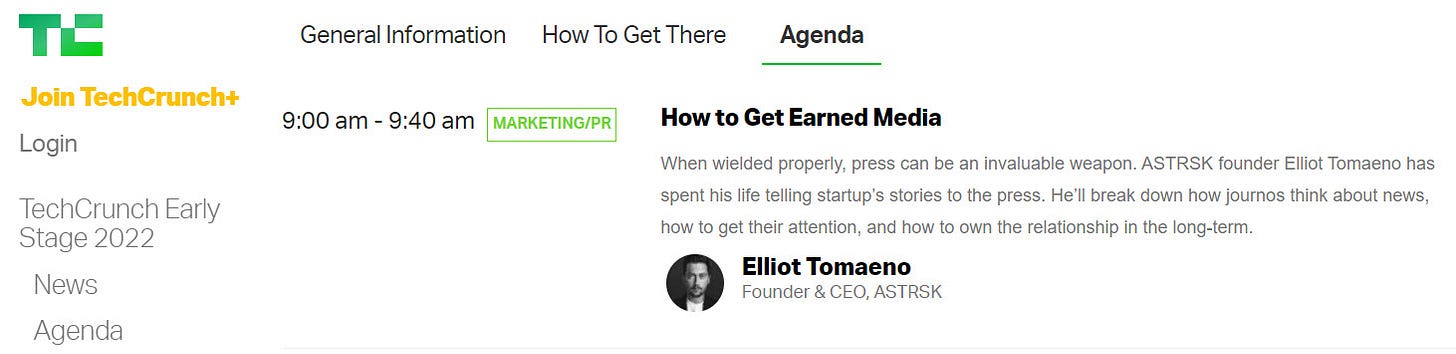

Last year, I attended TechCrunch and had the privilege to attend a session titled "How to Get Earned Media" by Elliot Tomaeno, Founder & CEO of ASTRSK. During the session, Tomaeno shared a set of invaluable insights, one of which particularly stood out: "You can get great PR results on your own."

Tomaeno's words underscored an essential truth about the world of public relations—effective PR doesn't always necessitate the involvement of external agencies. This notion confirms that not only publicly traded companies but any company can take a do-it-yourself (DIY) approach to PR, and external PR firms may not be a necessity. For instance, former President Donald Trump used the pseudonym "John Barron" (sometimes "John Baron") throughout the 1980s to pitch his own stories in the media and control the narrative, showcasing that individuals and organizations can, at times, effectively manage their PR efforts independently.

It's a sentiment that resonates deeply with my background as a Wall Street veteran, former analyst, and market maker. Throughout my career, I've witnessed firsthand how publicly traded companies strategically release news and shape their public image. These corporations employ a variety of methods, from crafting compelling press releases and maintaining in-house PR teams to establishing direct communication channels with the media. Moreover, some choose to collaborate with external PR firms to augment their communication efforts and tap into additional resources.

As we unravel the complex relationship between publicly traded companies, Wall Street analysts, the media, and PR firms, a nuanced perspective on the role of public relations emerges. From the initial debate about the necessity of external PR firms to the hidden advantages for PR agencies to benefit from 'freebie' coverages without having to do any work or pitches for such coverage, and reap the rewards, benefits, and credits, it's evident that the world of corporate communications is multifaceted.

Let's zero in on how publicly traded companies may do PR firms a favor because of their publicly traded status. There are a number of Wall Street analysts who are already assigned to cover these stocks due to their affiliation with investment banking firms, which either make a market in the stock or have an ownership stake in it through various funds or clients. Consequently, when a publicly traded company issues a press release or publishes a blog post, major news outlets such as The Wall Street Journal, Barron's, Financial Times, TechCrunch, Bloomberg, and Reuters automatically pick up the news and pen a piece about it.

Elliot Tomaeno's insights at TechCrunch emphasize that effective PR doesn't always depend on external agencies—a concept that aligns with my firsthand experience in the financial world. Publicly traded companies, by virtue of their unique status, have the potential to provide 'free PR' pieces. In this scenario, external PR firms can indirectly benefit, receiving credit for media coverage even when they may not necessarily have been directly involved in securing it.

The PR Firm's Hidden Gains: A Unique Vantage Point

In the realm of public relations, it's not uncommon for PR firms to discover unexpected perks when working with publicly traded companies. This often stems from the symbiotic relationship these corporations maintain with Wall Street analysts, which, intriguingly, can translate into what may seem like 'free publicity.' Here's a closer look at how PR firms can find themselves on the receiving end of these hidden advantages:

Analyst Coverage: The Unseen Link: Publicly traded companies listed on major stock exchanges typically attract a dedicated pool of Wall Street analysts who closely follow and analyze their stock. These analysts, affiliated with investment banking firms, have a vested interest in the companies they cover. This interest may arise because their firms either make a market in the stock or have an ownership stake through various funds or clients.

Media Amplification Through Financial Markets: When a publicly traded company issues a press release or publishes a blog post, the impact often extends far beyond the initial announcement. This is where the hidden gains for PR firms come into play. Major news outlets, including esteemed publications like The Wall Street Journal, Barron's, Financial Times, and even tech-centric platforms like TechCrunch, are attuned to the influence and importance of publicly traded companies in the financial world.

Market Ripples and Media Echoes: Publicly traded companies' actions and announcements can send ripples through the financial markets. Stock price movements, quarterly earnings reports, high-stakes mergers and acquisitions—all of these are closely monitored by investors. The ensuing discussions generated by these events spark headlines and discussions in the media, further fueling public interest.

Why Publicly Traded Clients Provide the 'Free PR' Pieces:

Now that we've highlighted how PR firms can unintentionally benefit from this unique setup, let's delve into why publicly traded clients may willingly offer these 'free PR' pieces:

Compliance and Transparency: Publicly traded companies are subject to rigorous regulatory scrutiny, necessitating a high level of transparency. By disseminating important information via press releases or blogs, they fulfill their obligations to shareholders and regulatory bodies.

Investor Relations: Publicly traded companies often have dedicated investor relations teams that aim to keep shareholders and analysts informed. Timely and transparent communication is crucial for maintaining investor trust.

Strategic Visibility: By sharing their accomplishments and future plans with the media, publicly traded companies can strategically bolster their visibility and reputation. This can enhance their ability to attract investors and business partners.

Market Sentiment: Publicly traded companies understand that positive market sentiment can drive stock prices higher. Effective communication can shape this sentiment, potentially benefiting shareholders.

While publicly traded companies may indirectly help external PR firms land 'freebie' hits, some opt to maintain external PR firms for various strategic reasons. These include:

Additional Resources: In-house PR teams may have limitations in terms of personnel or time. During peak periods or when handling major projects that require more resources than the in-house team can provide, a PR firm can supplement their efforts.

Crisis Management: Companies often engage external PR firms for crisis management due to the benefits of having a neutral third party handle contentious situations. This strategic choice offers several advantages in effectively navigating high-stakes crises while safeguarding reputation and public perception. By working with an external PR firm, companies can maintain separation from the crisis, enabling them to address the issue impartially and strategically. This distance can be crucial when emotions are running high and when the company's direct involvement may exacerbate the situation rather than resolve it.

Cost-Effective Solutions: Contrary to the assumption that external PR firms are more expensive, in some cases, they can provide cost-effective solutions. Hiring a PR firm for a short-term project might be more budget-friendly than hiring additional permanent staff.

These considerations demonstrate that the relationship between publicly traded companies and external PR firms is multifaceted, driven by strategic goals, and goes beyond merely benefiting from 'freebie' media coverage.

In conclusion, the intricate interplay among publicly traded companies, Wall Street analysts, the media, and PR firms reveals a multifaceted dimension of corporate communications. It commences with the debate surrounding the role of external PR firms and extends to unveil the unexpected advantages PR agencies gain in securing 'freebie' media coverage. While publicly traded companies, owing to their unique status, can offer 'free PR' pieces that indirectly benefit external PR firms, this partnership goes far beyond happenstance.

So, are there benefits for publicly traded companies in hiring an external PR agency? The answer to this question is a case-by-case matter. It hinges on a range of factors, including the CEO's communication strategy, the company's specific goals, and whether the aim is to secure 'puff pieces' or to strategically navigate the complex landscape of corporate communications.

UPDATE:

Listen to the “UPDATE” audio version here:

Since this article was published, I’ve received many questions about the differences between earned and paid media, along with their pros and cons. Having worked with a lot of PR firms—some charging as much as $20,000 per month for their services, whether for my own companies or those I was affiliated with—I’ve gained plenty of firsthand experience. So, trust me when I say, I know what I’m talking about...

Paying for a PR firm raises questions about "earned" media—can it really be considered earned if the journalist consistently writes for the same PR firm's clients?

When coverage stems from long-standing relationships between PR firms and reporters, it starts to feel more like “favored” media, where PR influence shapes the narrative rather than genuine newsworthiness.

Is paid media bad, or is it not "earned"? It depends on who you ask. Personally, I believe paying a PR firm for "earned" media is still paid media because you’re compensating the PR firm to get it. Even Donald Trump’s team has paid for much of their "earned" media—so would that make it "unearned"? (LOL) Paid media, however, is more straightforward. You know what you’re paying for, and it often guarantees the same, if not better, results.

Tier-1 media outlets still reject paid content if it doesn’t meet their standards. Sometimes, their reporters will even conduct interviews based on the initial intent of a “paid media pitch.”

PR firms are a dime a dozen, meaning they’re everywhere—there’s no license required to set up a business.

Many PR firms promise media placements but CAN’T guarantee results, often blaming it on the client’s lack of recognition. But isn’t that weird, I mean if you were already well-known, why would you need a PR firm? LOL

Some PR firms claim they can "strategically put out fires" if you make a fool of yourself in public, but for people like Elon Musk or Donald Trump, making a fool of themselves is so routine that no PR firm can help them, nor can they effectively pitch their side of the story to secure that so-called “earned” media.

Many boutique PR firms struggle to solve their own issues, let alone handle someone else's crisis. Most PR firms will argue the difference between paid and earned media, because admitting otherwise would put them out of business.

The reality is, many PR firms promise significant exposure but often deliver mediocre results at high monthly costs, where "earned" media is actually "favored media," lacking authenticity. PR firms may claim that paid media isn’t truly earned, but the truth is, earned is earned—whether you're paying a PR firm to secure it for you or you work directly with media outlets yourself. The latter remains a more transparent and reliable way to secure coverage, as even figures like Trump use paid media for strategic campaigns.

As a business enthusiast, I found this article incredibly enlightening. It's like a backstage pass to understanding how publicly traded companies navigate the complex world of PR. The insights into the interplay between PR firms, Wall Street, and the media are eye-opening. Definitely a must-read for anyone curious about the dynamics of corporate communications! 👏

What other strategic reasons might publicly traded companies have for maintaining external PR firms, as mentioned in the article?